All categories >

Just now! Trump announced he will impose tariffs of up to 100% on imported building materials, furniture, and pharmaceuticals—effective October 1!

Categories:

Time of issue:

2025-09-26 17:46

Starting in October, three categories of imported goods face a "tariff tsunami."

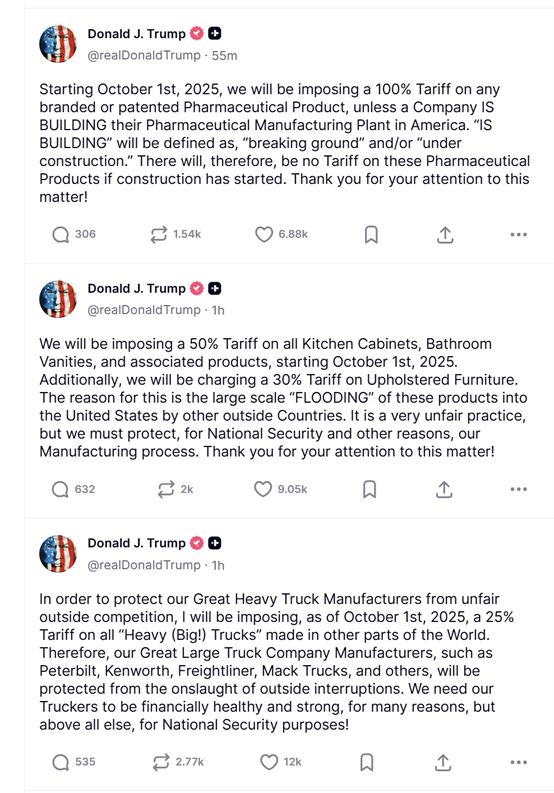

On September 25 local time, Trump posted three consecutive messages on the social platform "Truth Social," unveiling a new round of tough tariff measures. The policy, set to take effect officially from October 1, is being described as "the toughest ever."

Building materials sector: Core home furnishing categories such as kitchen cabinets and bathroom vanities will face an immediate 50% tariff increase.

Furniture Industry: All imported furniture is subject to a 30% tariff, covering the entire product range—including solid wood, panel furniture, and more.

Pharmaceutical Sector: Patented and branded drugs face a "doubling" of tariffs, with duty rates reaching as high as 100%.

More alarmingly, heavy-duty trucks have also been hit with an additional 25% tariff, marking a synchronized escalation in tariffs across four key sectors—and creating a ripple effect that now spans from consumer goods to industrial production. In a post, Trump claimed the move was aimed at "protecting U.S. manufacturing processes" and countering "unfair foreign competition." He even included an "exception clause" for pharmaceuticals, exempting only those companies that have already broken ground on new factory construction projects within the United States.

America's "triple bill" is already on the way.

The tariff club has come down, and first in line are the wallets of ordinary American families. According to data from Yale’s Budget Lab, the current average U.S. tariff rate has already reached 18.7%, hitting a new high since 1933—and the new policy will further shift these costs onto consumers.

1. Home renovation costs soar, making homeownership and renovations even more challenging.

Building material tariffs are directly hitting the booming U.S. home improvement market. Take, for example, the kitchen renovation of an average-sized home: imported cabinets currently account for about 35% of the total cost. A 50% tariff would mean that cabinet expenses alone would jump by 17.5%. CNN has already sounded the alarm, noting that prices for imported building materials like doors, windows, and flooring surged by 4.2% in June—marking the largest price increase on record. With the new policy now in effect, this could trigger a "chain reaction of skyrocketing home improvement costs."

2. A wave of furniture price hikes hits, putting pressure on middle-class consumers.

Imported furniture accounts for over 40% of the U.S. market share, and a 30% tariff will be directly passed on to end-consumer prices. From IKEA’s assembly cabinets to high-end solid wood furniture, prices are expected to rise by 15% to 20%. Heather Long, chief economist at the Navy Federal Credit Union, noted: "These aren’t fast-moving consumer goods you buy every week, but rising furniture prices will directly squeeze families’ other expenses—especially impacting middle-income households significantly."

3. Life-saving medication prices double, leaving patients in a desperate situation

A 100% tariff on pharmaceuticals is nothing short of the "deadliest blow." The U.S. is the world's largest importer of medicines, with patented drugs supplied by countries like Ireland and Germany accounting for over 60% of its imports. Once the tariffs take effect, prices of critical medications such as insulin and cancer treatments could double. Earlier steel and aluminum tariffs already drove up the cost of drug packaging materials, but now the direct targeting of pharmaceuticals themselves has sparked growing public outcry among patient communities.

Why has the conservation policy become a "double-edged sword"?

Trump's proclaimed goal of "revitalizing manufacturing" is now facing the harsh reality that sharply contradicts his claims. Looking back at the impact of this year's steel and aluminum tariffs reveals even more clearly the policy's paradox:

1. Local enterprises have not benefited—they've instead fallen into a supply-chain crisis.

U.S. steelmaker Cleveland-Cliffs has halted operations at three facilities due to the 50% tariffs on steel and aluminum, citing a "domestic billet shortage of 5 million tons, forcing the company to rely on imports—though the tariff costs have become prohibitively high." Now, building material tariffs are set to follow the same pattern: U.S. domestic production capacity for construction materials currently meets only 60% of demand, leaving the country heavily dependent on imports—a reliance that cannot be reversed in the short term. Ultimately, these tariffs will translate into higher production costs for local construction firms.

2. Inflation spiral accelerates, putting the Federal Reserve's control efforts on hold

Barclays Research noted that tariffs have already pushed up the overall U.S. price level by a cumulative 0.8%, with three-quarters of this increase yet to fully materialize. Unlike demand-driven inflation, the inflation triggered by tariffs is "structural and persistent," making it difficult for tools such as Federal Reserve rate hikes to effectively address the issue. Zhou Mi, a researcher at the Ministry of Commerce, bluntly stated: "Repeated tax hikes are intensifying inflationary pressures in the U.S., creating a vicious cycle of 'tax hike—price increase—further tax hike.'"

3. Corporate investment sentiment declines, hitting the job market hard

Twelve states once joined forces to sue the federal government, accusing the tariff policy of being "illegal and causing job losses." Now, the new policy will further hurt manufacturing industries that rely heavily on imports: furniture factories may cut jobs due to soaring raw material costs, pharmaceutical distributors face squeezed profit margins, and the construction sector is experiencing project delays as rising costs take their toll. The ripple effects in the job market could become evident by the end of the year.

Global tremors as trade war tensions flare up again?

The tariff club not only stirs up the U.S. domestic market but also triggers global trade ripple effects:

1. Allies take the lead in rebounding as EU refuses to "choose sides"

The United States' top five truck-importing countries include allies such as Mexico, Canada, and Germany, while imports of furniture and pharmaceuticals also heavily rely on Europe. However, the European Union has clearly stated it "will not follow Trump's tariff policies." As noted by France's Le Monde, German automakers and French luxury giants—among others—cannot afford to do without global markets and are reluctant to foot the bill for U.S. policies. Earlier, the EU had already imposed hefty fines on American companies like Apple and those involved in the metaverse, escalating the risk of trade confrontation.

2. Supply chain restructuring accelerates, disrupting global division of labor

From steel and aluminum to construction materials and pharmaceuticals, the U.S. continues to expand the scope of its tariffs, forcing companies to rethink their supply chains. However, the short-term costs of restructuring are extremely high—despite facing a 50% tariff, Brazilian steelmakers still exported 752,000 tons of products to the U.S. in June, underscoring the "structural supply gap that remains difficult to fill." Ultimately, this artificially fragmented approach to global supply chains will drive up the overall cost of global trade.

Who's paying the price for the tariff policy?

From steel and aluminum to automobiles, and from construction materials to pharmaceuticals, Trump’s tariff club has been wielded for more than six months—but data reveals: U.S. manufacturing PMI has declined for three consecutive months, inflation remains stubbornly high, and the trade deficit hasn’t narrowed at all. As New York State Attorney General James put it: "These so-called protectionist policies are nothing but forcing American consumers and businesses to foot the bill for the president’s political ambitions."

As the October 1 tariff implementation date draws nearer, this trade standoff—where no one emerges as a clear winner—will ultimately end in someone’s loss. The answer may already be written on the ever-rising price tags and in the layoff notices issued by businesses.

Shenzhen Huijetong International Freight Forwarding Co., Ltd. – Professional U.S. Route Shipping Services

In the U.S.-bound shipping sector, Shenzhen Huijetong International Freight Forwarding Co., Ltd. has become a trusted choice for numerous clients, thanks to its professional services and extensive experience. Specializing in U.S.-bound transportation, Huijetong offers comprehensive logistics solutions, including sea freight, air freight, land transportation, and warehousing services. The company maintains close partnerships with major shipping alliances, enabling it to provide flexible cargo arrangements and highly efficient transportation services tailored to customer needs.

Choosing Hujiatong International Freight Forwarding Co., Ltd. means choosing professional, efficient, and reliable logistics services. For more details, please visit [Hujiatong’s official website www.szvif.com].

Choose Huijetong when you travel to the U.S.!

Shenzhen Huijietong International Freight Forwarding Co., Ltd.—your professional U.S. East Coast shipping partner.

Service Hotline: 0755-82171929 13560787209

WeChat QR Code