All categories >

Major News! The "Buy-Out Export" model will be completely terminated and officially implemented on October 1st!

Categories:

Time of issue:

2025-07-25 17:41

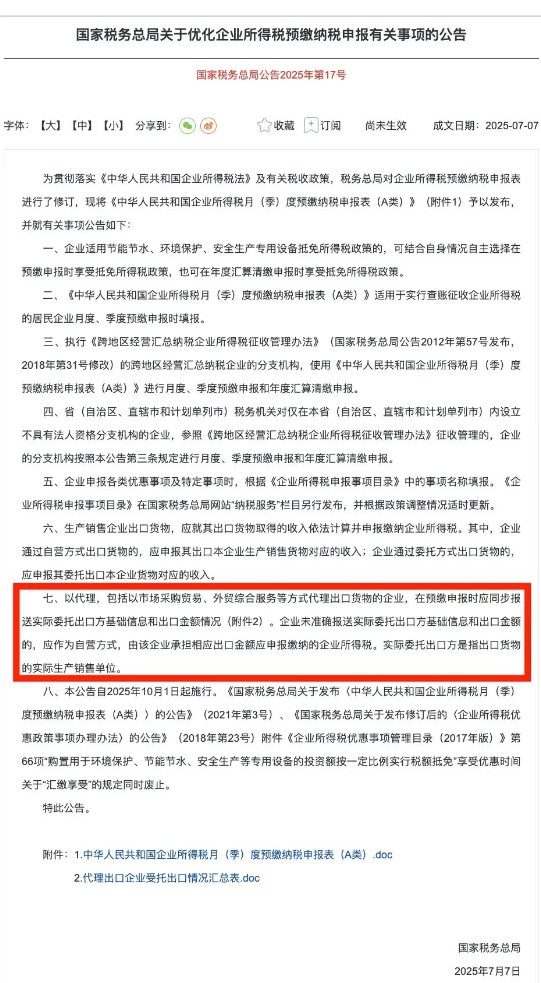

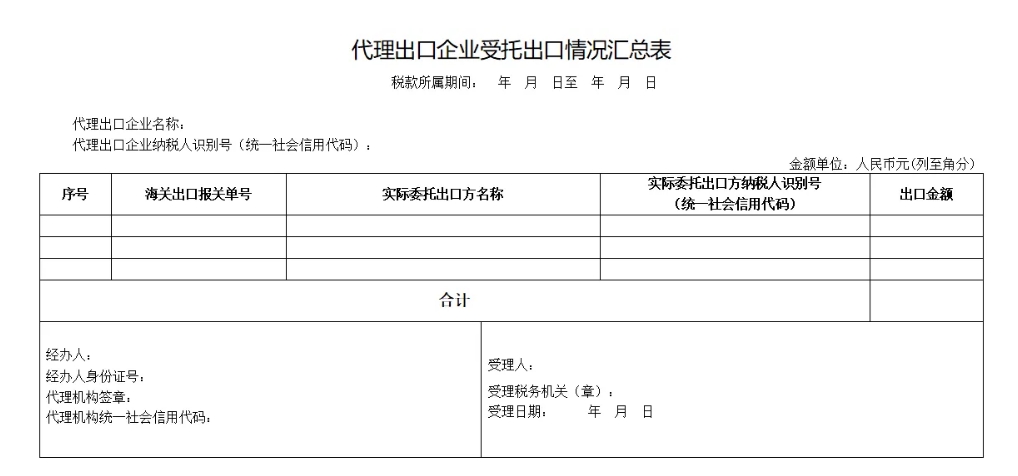

On July 7, 2025, the State Taxation Administration issued the "Announcement on Optimizing Matters Related to the Prepayment Tax Declaration of Enterprise Income Tax" (No. 17 of 2025), which will come into effect on October 1, 2025. Among them, Article 7 has a significant impact on export businesses, and may end the "payment on behalf of others for export" model.

"Payment on behalf of others for export" refers to enterprises without import and export operating rights using the name of a company with import and export rights to export goods. This clause clarifies that enterprises exporting goods through agents (including market procurement trade, foreign trade comprehensive services, etc.) must simultaneously submit the basic information and export amount of the actual entrusted exporter when prepaying and declaring. If the enterprise fails to accurately report, it will be treated as a self-operated method, and the enterprise will bear the enterprise income tax payable for the corresponding export amount.

01

Why is "payment on behalf of others for export" being terminated?

"Payment on behalf of others for export" itself is not equivalent to tax evasion, but in the operation process, if it involves "payment on behalf of others for export with matching invoices for tax refund" fictitious transactions, or false issuance of value-added tax invoices, it will evolve into illegal acts of defrauding the state's export tax refunds.

In recent years, the State Taxation Administration and the General Administration of Customs have linked data through "Golden Tax Phase IV", "Single Window + Blockchain", etc., to achieve cross-verification of export data. Enterprises with high-frequency exports, zero declarations, high tax refund amounts, and frequent payment on behalf of others are listed as key monitoring targets.

The tax authorities will list the following types of enterprises with abnormal export income comparison as high-risk:

? Enterprises that pay on behalf of others for export; Agent export enterprises that undertake "payment on behalf of others for export" business , covering supply chain, foreign trade comprehensive services, foreign trade, and logistics companies, etc.

? Suppliers fail to issue invoices on time, customs declaration is delayed Confirmation of income, inability to declare exports in the same month as export (confirmation of income based on accounting or collection time), special customs declaration trade methods (such as sample and advertising goods), and export enterprises that do not confirm export income based on FOB price.

02

Risk cases of "payment on behalf of others for export"

Once, an enterprise colluded with a customs declaration company, forged the real export information of an individual to forge J company as the cargo owner, and cooperated with false invoices to defraud tax refunds, eventually defrauding 11.3 million yuan in tax refunds, and another 4.3 million yuan in tax directly deducted by false invoices. The court sentenced J company to a fine of 6 million yuan, and Cui Mou, the relevant person in charge, was sentenced to 14 years in prison and a fine of 5.8 million yuan; Wan Mou (introducing false invoices) was sentenced to 10 years and 6 months, and Su Mou, the financial officer, was given a suspended sentence of 3 years.

03

Relevant policies continue to tighten

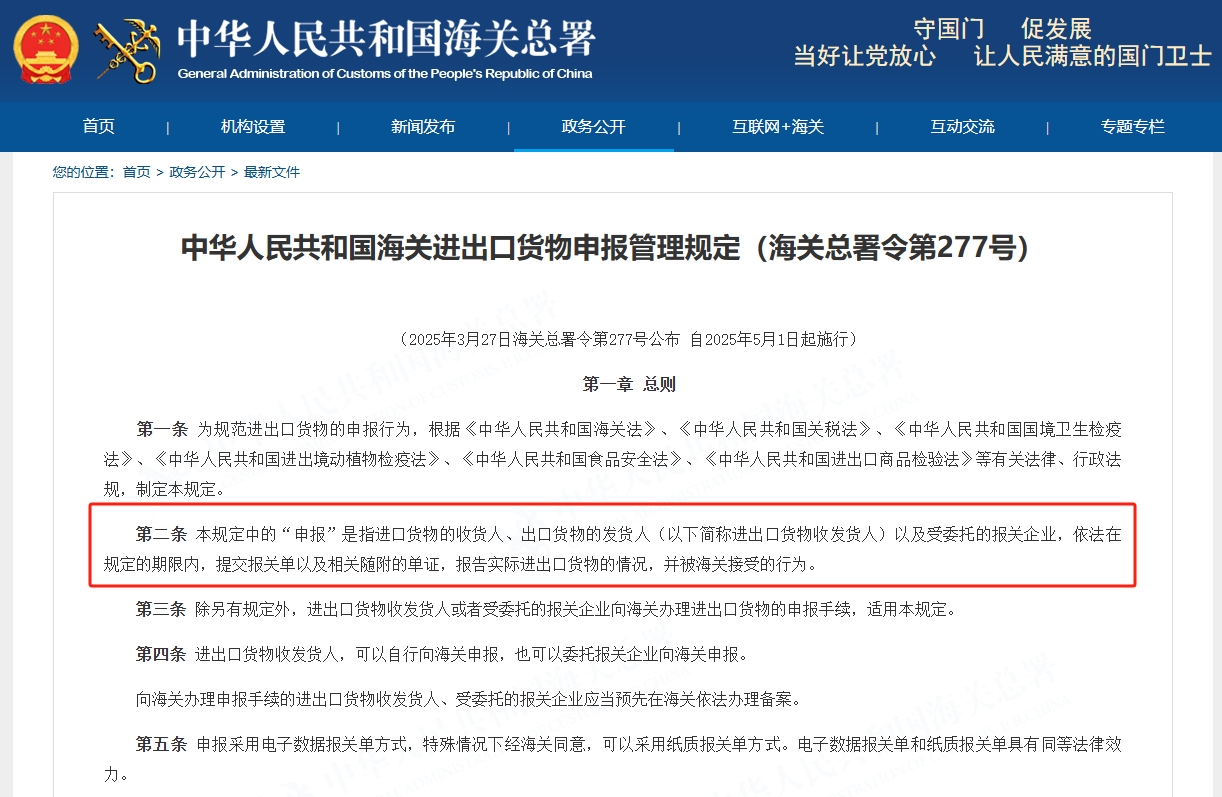

Actually, "Payment on behalf of others for export" has been under strict scrutiny since 2024. On March 27, 2025, the General Administration of Customs issued the "Regulations on the Declaration Management of Import and Export Goods of the Customs of the People's Republic of China" (Order No. 277 of the General Administration of Customs), and it will be implemented from May 1 . According to Order No. 277, customs brokers are responsible for customs declarations (i.e., responsible for the customs declaration behavior of export business, and severely crack down on fictitious behavior and buying and selling customs declarations).

Customs and tax authorities implement comprehensive sharing , as long as the customs punishes export enterprises and customs declaration enterprises for false customs declarations, it will be sent to the relevant tax authorities immediately.

Tax authorities will pursue illegal export businesses to the end , if it is a customs broker's violation, the customs broker will be punished; if the customs broker is cancelled, the freight forwarder's responsibility will be traced; if the freight forwarder does not exist, the agency company and the cargo owner will be found.

The state must collect the tax involved in illegal business, punish the violators and assistants, and transfer serious cases to judicial organs.

On the evening of March 28, the State Taxation Administration, the Ministry of Finance, the Ministry of Commerce, the General Administration of Customs, and the State Administration for Market Regulation jointly issued the "Announcement on Optimizing Services and Standardizing Management of Export of Goods Subject to Domestic Taxes" (No. 8 of 2025).

The Announcement specifically mentions: "Those who forge, alter, buy and sell customs declarations, fabricate export businesses, underreport the value of goods, evade taxes, or assist in the implementation of the above illegal acts will be dealt with by the relevant departments according to their respective responsibilities and in accordance with the law and regulations." This means that the country's crackdown on "payment on behalf of others for export" and other issues has risen from past sporadic actions to the level of laws and regulations.

04

Impact on enterprises and suggestions for response

"The era of payment on behalf of others for export is over" is the inevitable result of China's foreign trade supervision shifting from extensive to refined, and from form to substance. It has brought about a significant increase in compliance costs and operating thresholds, eliminating non-compliant entities, but it has also promoted the transformation and upgrading of foreign trade formats and the purification of the market environment.

For enterprises that previously relied on "payment on behalf of others for export", they should adjust their business models as soon as possible. On the one hand, they can consider applying for their own import and export operating rights, although the process may be cumbersome, but in the long run, it can ensure the compliance and stability of the business;

On the other hand, they can also choose regular foreign trade comprehensive service enterprises for agency exports, using their professional services to meet regulatory requirements. At the same time, enterprises should strengthen internal financial management and tax compliance awareness, ensuring that every aspect of export business complies with laws and regulations, and avoiding huge losses due to non-compliant operations.

The end of payment on behalf of others for export is not the end of foreign trade, but the beginning of compliant competition. For market entities, the only way out is to embrace compliance Choose a suitable path (self-operated, compliant agency, market procurement, cross-border e-commerce) based on your own circumstances, and establish a sound internal risk control system to adapt to the more transparent, stringent, and rule-of-law-based new foreign trade environment.