All categories >

Customs seized 24.7 tons of fireworks smuggled in international sea freight for export (Attention cargo owners and freight forwarders: Do not underreport or misreport)

Categories:

Time of issue:

2025-05-22 16:51

With the announcement from China and the US to cancel 91% of the additional tariffs and suspend 24% of retaliatory tariffs for 90 days, this significant positive news acted like a shot in the arm, quickly revitalizing the China-US trade market. Numerous foreign trade companies are eager to seize this 90-day window of opportunity, making every effort to resume their business with the US, hoping to achieve rapid business growth during this short period of tariff reduction. However, market changes are always complex and volatile, with issues such as shipping companies collectively raising prices on US routes and severe port congestion emerging one after another, bringing new challenges to foreign trade companies. So, how should foreign trade professionals deal with shipping company price increases, seize opportunities, and mitigate risks during this 90-day tariff reduction period? Today, let's delve into this topic.

I. Shipping Company Price Increases and Port Congestion: New Challenges Facing Foreign Trade Enterprises

(I) Collective Price Increases by Shipping Companies

Faced with the surge in shipments from foreign trade companies, shipping companies have chosen to collectively raise prices on US routes. Earlier, affected by tariff policies, many international shipping companies reduced their capacity supply to the US market, shifting to European and Middle Eastern routes. Now, with the sudden surge in demand, capacity cannot be met immediately, leading to tight cabin space and providing an opportunity for shipping companies to raise prices.

• Maersk: From May 22, the MAF (Marine Adjustment Surcharge) from Ningbo, Shanghai, and Xiamen in China to the US will increase by US$1500 per 40-foot container.

• ONE: Announced a US$1000 per 40-foot container increase in FAK rates on US routes and plans to introduce a peak season surcharge (PSS) with an expected increase of US$2000 on May 21.

• Hapag-Lloyd: Will increase freight rates on US routes from June 1, with a specific increase of US$3000 per 40-foot container.

• Mediterranean Shipping Company: Plans to introduce a peak season surcharge of US$1600-2000 from June 1.

• Evergreen Marine: Has been the most active, first planning to increase GRI from May 15 to May 31, with a direct price increase of US$700 for large containers, and then announcing another peak season surcharge (PSS) on May 23, with an increase of US$1500 per large container. The cumulative increase in freight rates on US routes in May will reach US$2200 per large container.

(II) Severe Port Congestion

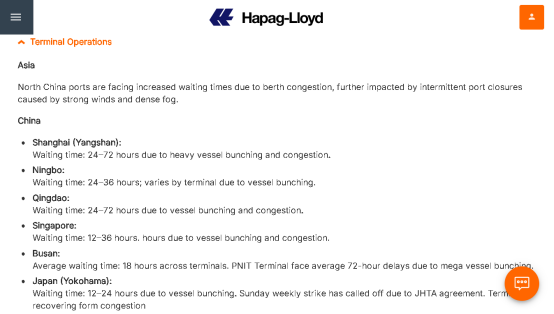

Recently, Hapag-Lloyd updated the latest Asian port information and warned that due to berth congestion, vessels at Shanghai, Ningbo, Qingdao, and other North China ports are facing increased waiting times. Among them, Shanghai (Yangshan): Due to dense and congested vessels, the expected waiting time is 24-72 hours; Ningbo Port: Due to varying degrees of vessel congestion, waiting times will vary, with an expected waiting time of 24-36 hours. In addition, the global port operations dynamics released by DSV also show that the congestion situation in Shanghai, Ningbo, and Qingdao ports is severe. As of last week, the number of vessels waiting at anchor in the Shanghai-Ningbo area has increased to 130, while Qingdao has 20 vessels berthed. US destination ports may also face congestion. Real-time satellite images of major US ports such as Los Angeles and Long Beach show that container ships waiting to berth have formed long queues. Moreover, the 90-day suspension period will end in the middle of the US summer shopping season, and US importers may seize the opportunity to stockpile more goods in the coming months, which will undoubtedly further burden the ports. Port congestion not only leads to longer cargo transportation times but also increases additional costs, such as demurrage. For foreign trade companies, this not only affects customer satisfaction but may also lead to breach of contract risks.

II. Countermeasures for Foreign Trade Enterprises

(I) Logistics Strategy Innovation

• In-depth application of overseas warehouses: Some companies have established transit warehouses in Mexico, utilizing tariff preferences under the USMCA to reduce transportation costs to the US by 25%. By storing goods in overseas warehouses in advance, not only can delivery times be shortened, but delays caused by port congestion can also be avoided.

• Multimodal transport combination: A toy company in East China adopted a cross-border transportation plan of "railway freight + US West Coast ports." Although the cost increased by 12%, the transportation time was shortened by 15 days, effectively hedging against tariff fluctuation risks. Reasonably combining various transportation methods and selecting the optimal plan based on cargo characteristics and transportation needs can alleviate the pressure brought by shipping company price increases and port congestion to a certain extent.

(II) Supply Chain Resilience Building

• Diversification of production capacity: An underwear company has shared 30% of its production capacity through its Vietnam factory, both avoiding tariff risks and shortening delivery cycles. This "China + Southeast Asia" dual supply chain model is becoming mainstream. Foreign trade companies can consider optimizing their production capacity layout globally, reducing their dependence on a single region to cope with various uncertainties.

• Inventory adjustment: An import and export company in Yiwu requested customers to "check inventory and replenish stock" and reserved a 15-day production buffer period to ensure delivery within the tariff window period. Reasonably adjusting inventory strategies, maintaining close communication with customers, and flexibly arranging production and shipments based on market demand and transportation conditions can avoid inventory backlog or stockouts.

(III) Active Communication and Negotiation

Maintain close communication with shipping companies and freight forwarders to obtain more favorable freight rates and cabin arrangements. At the same time, negotiate with customers to share some of the pressure from increased logistics costs and jointly address the current difficulties. In addition, promptly feedback the cargo transportation status to customers to avoid misunderstandings and disputes caused by poor information.

(IV) Monitoring Policy Dynamics

Although the 90-day tariff window period brings opportunities, there is uncertainty in the policy. Foreign trade professionals should continuously monitor changes in China-US trade policies and prepare in advance so that they can respond quickly when policies are adjusted.

During the 90-day window period of China-US tariff adjustments, foreign trade companies have both seized rare opportunities and faced numerous challenges such as shipping company price increases and port congestion. However, as long as we actively respond, innovate logistics strategies, build supply chain resilience, strengthen communication and negotiation, and closely monitor policy dynamics, we will surely be able to seize opportunities, mitigate risks, and achieve stable business development during this special period. Let's work together to meet the challenges and create a better future!

The foreign trade path is full of opportunities and challenges, but as long as we bravely move forward, we will surely overcome the waves and reap a rich harvest. Follow us to get more foreign trade information and practical knowledge, helping your foreign trade business to flourish!