All categories >

U.S. port fees are set to be imposed—global shipping giants make their stance known!

Categories:

News Center

News

Time of issue:

2025-09-19 16:21

Views:

The Fee Structure at U.S. Ports Holds a Hidden Mystery

There's less than a month left until October 14, 2025. The U.S. port surcharge policy targeting Chinese vessels is set to officially take effect soon.

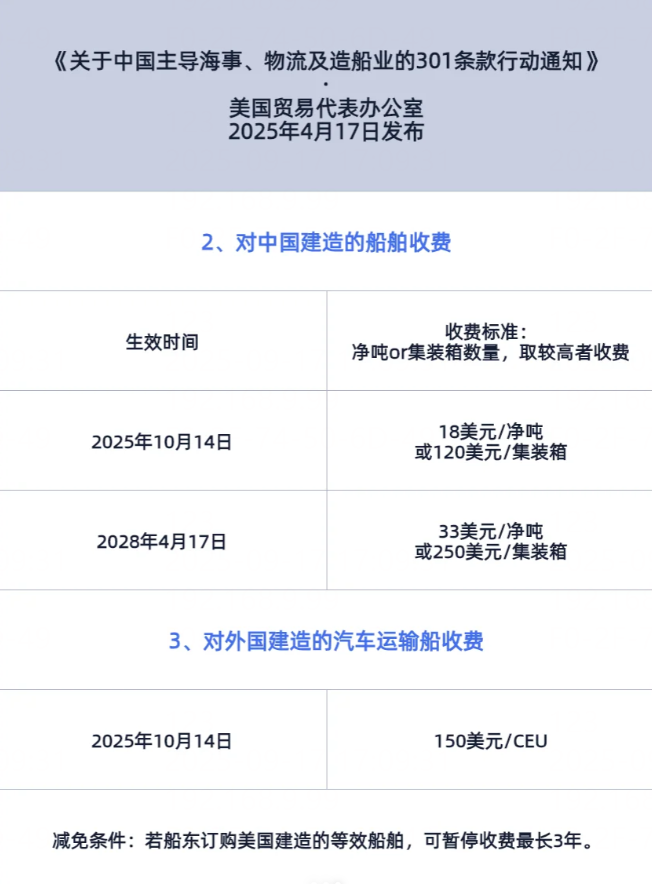

This new regulation, dubbed the "shipping tax" by industry insiders, establishes a clear fee structure based on vessel characteristics:

Chinese shipowners/operators: In 2025, the levy will be set at $50 per net ton, soaring to $140 per net ton by 2028, with a maximum of five charges per vessel each year.

Not Chinese-funded but using China-made vessels: This year, charges are set at $18 per net ton or $120 per TEU, increasing to $33 per net ton and $250 per TEU respectively after three years.

Take, for example, a Chinese-built container ship with a net tonnage of 12,000 tons—its basic port call fee alone amounts to $216,000. And if we calculate based on a cargo capacity of 8,000 TEUs, the cost soars even higher, reaching as much as $960,000. Vessels that fail to pay on time will face severe penalties, including being prohibited from operating or detained from leaving port.

It is worth noting that, The new regulations include a limited number of exemption clauses: U.S.-domestic shipping vessels, empty bulk cargo ships, and certain roll-on/roll-off vessels may apply for exemptions or refunds. However, container ships commonly used in cross-border e-commerce are almost invariably included within the scope of taxation.

The four major shipping giants jointly issue statements

Faced with immense cost pressures, the world's four major shipping giants have recently spoken out one after another, However, attitudes show remarkable consistency. — ‘ Do not pass on the additional costs to the shippers. ’, But the underlying response logics each have their own focus:

0 1 Maersk: Using the "ship-swapping technique" to sidestep fees, U.S. routes are entirely switching to non-Chinese-built vessels.

As one of the first shipping companies to speak out, Maersk clearly stated as early as last year, " Won't make customers pay extra. "。

Its core strategy is [Global Capacity Realignment] : We are diverting all Chinese-built vessels under our fleet away from U.S. routes and redirecting them to unaffected markets such as Europe and Southeast Asia, while prioritizing the deployment of South Korean- and Japanese-built ships on trans-Pacific routes.

With the world's most flexible route network, Maersk has completed the replacement of vessels on its U.S. routes, effectively sidestepping the toll-triggering red line from the outset.

0 2 MSC: Bearing the costs head-on and adjusting routes, new ship orders still place bets on Chinese shipyards.

MSC's response further highlights its "dual-track approach":

On one hand, openly committing to Even if it can't be completely avoided, it will absorb the costs on its own. "By replanning global ship routing, we can reduce the frequency of Chinese-built vessels calling at U.S. ports;

On the other hand, the shipbuilding plan has not been adjusted. ——Data shows that 106 new ships are still under construction at Chinese shipyards, with a total capacity of 1.9 million TEUs. The future will involve diversifying risks through route mismatches.

03 CMA CGM: Lock in the cost structure, internally absorbing operational pressures.

CMA CGM recently stated clearly, " Currently, there are no plans to increase fees for U.S. routes. "…, and the secret lies in…" Optimize the operational plan in advance ”:

By adjusting fleet scheduling and consolidating the density of certain routes, the additional costs will be distributed across the global network, preventing a sharp surge in expenses for any single route.

The company emphasized " The services and pricing remain unchanged. "…giving sellers reliant on the U.S. shipping lines a 'reassuring pill'."

04 COSCO Shipping: Optimize the product structure while maintaining cost competitiveness in the market.

COSCO Shipping stated that although this fee may pose certain challenges to the company's operations, However, COSCO Shipping Lines remains fully confident in its U.S. route network services. and consistently invest in stable capacity, maintain reliable service quality, and continuously deliver dependable, safe, and high-quality logistics solutions to our customers.

Meanwhile, COSCO Shipping Lines will actively refine its product structure to meet the evolving demands of the U.S. market, while maintaining freight rates and surcharges—along with other related policies—that remain competitive and aligned with market standards.

However, not all shipping companies share the same attitude, Hapag-Lloyd bluntly stated, "We have no choice but to pass the additional costs on to our customers." It is expected that its U.S. line costs per FEU will increase by $89 to $163.

The shipping company isn’t raising prices, but these hidden costs will still "drain resources."

Although the shipping giant's "no-price-increase commitment" has stabilized market expectations, cross-border sellers still need to remain vigilant about the ripple effects triggered by policy changes. Especially these three hidden risks:

0 1 Extended lead times + soaring inventory costs

To avoid tolls, some shipping companies have already begun adjusting their routes: Switching from direct U.S.-to-Western Europe shipping to land transportation via Mexico and Canadian ports as a transit point has resulted in a delay of 7 to 10 days. This means sellers will be forced to increase their safety stock levels.

0 2 FOB terms "become invalid"—hidden pitfalls in port surcharges at the destination port

Many sellers believe that signing FOB terms can help them avoid risks, However, the shipping line has already begun charging the consignee a "Destination Port Terminal Surcharge." If the recipient refuses payment, resulting in the goods being detained, the seller will still be responsible for container detention fees, port detention charges, and even platform penalties for delays in Amazon FBA inventory placement.

03 Hidden Traps: Cabin Premiums Emerge, Making "Non-China-Built" Cabin Space Even Harder to Secure

Since non-Chinese-built vessels are exempt from certain fees, shipping companies prefer to allocate these slots first, resulting in a premium for "non-China-built" cargo space. During peak season, small and medium-sized sellers may face the dilemma of "having the money but being unable to secure shipping space."

The shipping giant's commitment to "self-funded costs," At its core, it’s about the global shipping industry safeguarding supply-chain stability—but the long-term impact of the new U.S. port fee regulations is still unfolding. For cross-border sellers, Rather than getting stuck on "whether shipping fees will increase," it's better to proactively optimize the logistics process. "After all, in the face of policy fluctuations, those who can effectively manage timing and costs will be better positioned to safeguard their profits."

Shenzhen Huijetong International Freight Forwarding Co., Ltd. – Professional U.S. Route Shipping Services

In the U.S.-bound shipping sector, Shenzhen Huijetong International Freight Forwarding Co., Ltd. has become a trusted choice for numerous clients, thanks to its professional services and extensive experience. Specializing in U.S.-bound transportation, Huijetong offers comprehensive logistics solutions, including sea freight, air freight, land transportation, and warehousing services. The company maintains close partnerships with major shipping alliances, enabling it to provide flexible cargo arrangements and highly efficient transportation services tailored to customer needs.

Choosing Hujiatong International Freight Forwarding Co., Ltd. means choosing professional, efficient, and reliable logistics services. For more details, please visit [Hujiatong’s official website www.szvif.com].

Choose Huijetong when you travel to the U.S.!

Shenzhen Huijietong International Freight Forwarding Co., Ltd.—your professional U.S. East Coast shipping partner.

Service Hotline: 0755-82171929 13560787209

WeChat QR Code

Keywords: