All categories >

What are value-added tax, output tax, input tax, simplified tax, VAT refund, and export tax rebate?

Categories:

News Center

News

Time of issue:

2025-07-04 16:49

Views:

These terms are all concepts related to value-added tax (VAT). Here are their detailed explanations:

1. Value-Added Tax (VAT)

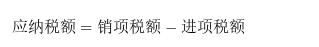

VAT is a turnover tax levied on the added value generated during the circulation of goods (including taxable services). Its core principle is to "only tax the added value," avoiding double taxation. The VAT calculation formula is:

Features:

• Multi-stage taxation: Levied at various stages of goods production, circulation, and sales.

• No double taxation: Through a deduction mechanism, only the added value of goods is taxed.

• Transferability: VAT is generally ultimately borne by the consumer.

2. Output Tax

Output tax refers to the VAT amount calculated based on the sales amount and applicable tax rate when a company sells goods, provides services, or provides taxable services. It is the tax payable at the company's sales stage.

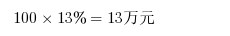

Calculation formula:

Example:

A company sells a batch of goods with sales of 1 million yuan and an applicable tax rate of 13%. The output tax is:

3. Input Tax

Input tax refers to the VAT amount paid to the other party when a company purchases goods, receives services, or receives taxable services. Input tax can be used to offset the company's output tax.

Calculation formula:

Example:

A company purchases a batch of raw materials with a purchase amount of 500,000 yuan and an applicable tax rate of 13%. The input tax is:

4. Simplified Tax

Simplified tax is a VAT calculation method applicable to specific businesses or small-scale taxpayers. The formula for calculating the payable tax amount under the simplified tax method is:

Features:

• Input tax credits are not allowed.

• The tax rate is usually lower than that of the general tax method.

• Mainly applicable to small-scale taxpayers or specific simplified tax collection items.

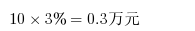

Example:

A small-scale taxpayer sells a batch of goods with sales of 100,000 yuan and a tax rate of 3%. The payable tax is:

5. VAT Refund for Taxpayers with Excess Input Tax Credits

VAT refund for taxpayers with excess input tax credits refers to the refund of the unoffset input tax when a company's input tax exceeds its output tax. This is a policy for refunding the VAT credit balance, mainly used to reduce the financial pressure on companies and encourage them to expand investment and technological upgrades.

Example:

A company's output tax for the month is 100,000 yuan, and its input tax is 150,000 yuan, with a credit balance of 50,000 yuan. If it meets the conditions of the VAT refund policy, the company can apply for a refund of the 50,000 yuan credit balance.

6. Export Tax Rebate

Export tax rebate refers to the refund of the VAT and consumption tax actually paid in the domestic production and circulation stages for export goods. Its purpose is to enable export goods to enter the international market at a tax-free price and enhance international competitiveness.

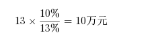

Calculation formula:

Example:

A company exports a batch of goods with a domestic procurement cost of 1 million yuan and an input tax of 130,000 yuan (assuming a tax rate of 13%). The export tax rebate rate is 10%, so the refundable tax amount is:

These concepts are very important in the collection and management of VAT, and both enterprises and tax authorities need to accurately understand and apply them.

Keywords:

Value Added Tax